Claim: India’s Economy is in deep trouble, and this is indicated by a 300% rise in gold loans in the last 5 years and a 22% overall increase in the number of women pledging gold

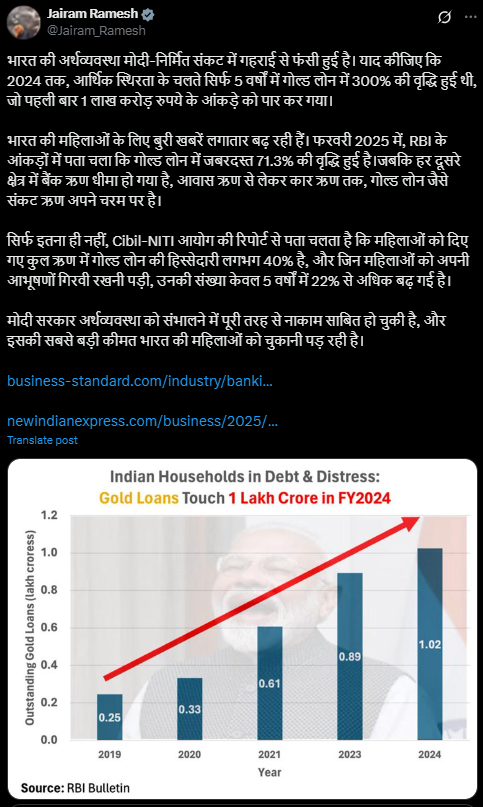

Senior politician Jairam Ramesh has been raising concerns on social media, claiming that the Indian economy is struggling. He points to a significant increase in gold loans, which have risen by 300% over the last five years, now exceeding ₹1 lakh crore. Ramesh also highlights that there is a 22% increase in the number of women pledging gold, suggesting that more people are facing financial difficulties. Below is his most recent tweet on this topic:

Jairam Ramesh’s Tweet

Our examination found the claim to be MISLEADING.

How we examined the claim:

- Data Collection and Gold Loan Trends

A. We collected RBI data on total outstanding gold loans every quarter from 2019 to 2024.

B. Using average gold prices for each year, we estimated how much jewelry was given for loans each year.

C. We also added data on how much gold was bought in India every year to compare.

D. This comparison shows that only a small part of the gold bought was used for loans. Most gold was kept for personal use, traditions, or as an investment.

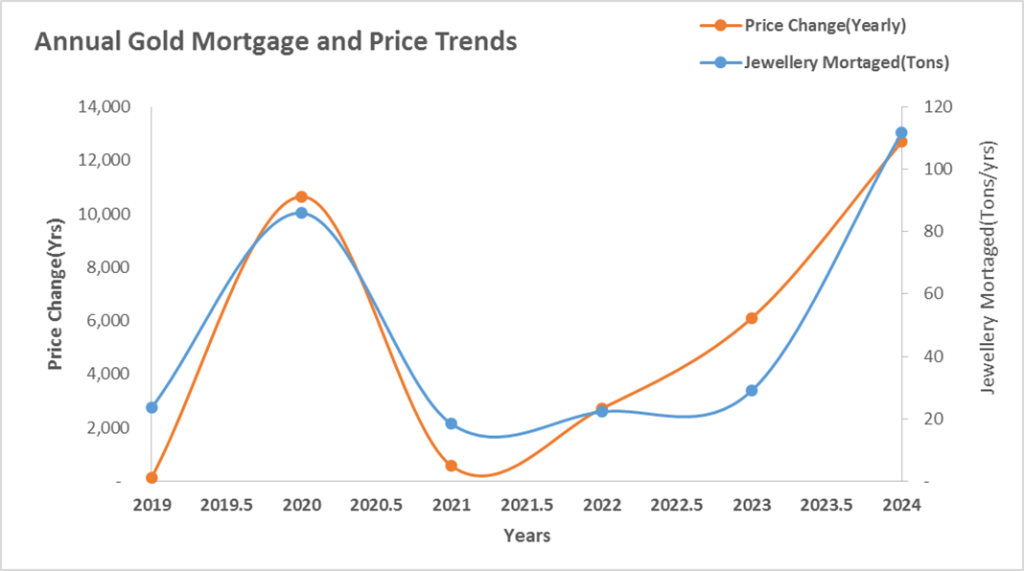

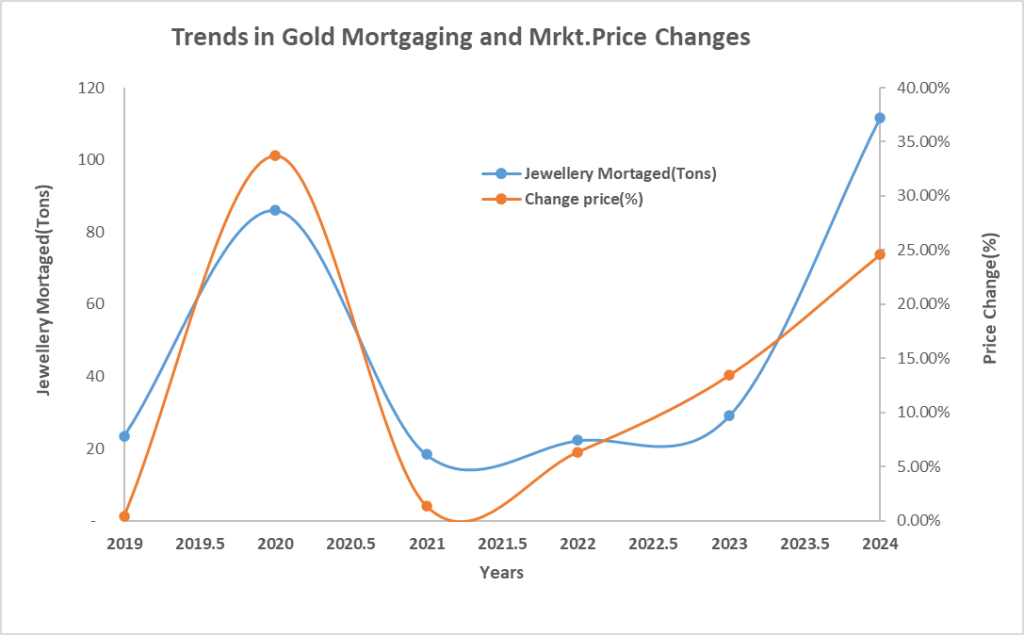

E. The highest amount of gold was given for loans in 2020 and 2024 — both years when gold prices were very high. This shows that people likely gave gold as a loan to make use of its high value, not because they were in serious money trouble.

| Year | Jewelry Mortgaged (Tons) | Gold Price Change (Rs) | Gold Purchased (Tons) |

| 2019 | 24 | 126 | 690 |

| 2020 | 86 | 10,648 | 446 |

| 2021 | 18 | 569 | 797 |

| 2022 | 22 | 2,718 | 803 |

| 2023 | 29 | 6,106 | 843 |

| 2024 | 112 | 12,696 | 1074(Estimated) |

F. This pattern is clearly visible in the graphs below, which show how gold mortgaging increased in the same years that gold prices spiked. It supports the view that people were responding to high gold prices, not financial distress.

Annual gold lent (Tons) against Price Increase

Annual gold lent (Tons) against % increase

2. Gold Outstanding vs. Gold Held by Indian Women

A. We compared the total outstanding gold loan as of December 2024 to the estimated gold holdings of Indian women.

B. Total estimated gold held: 24,000 tons, valued at ₹2,20,78,800 crore.

C. Total gold loan outstanding: ₹1,72,581 crore (just 0.8% of the value of gold held).

D. We then got the average Gold price every quarter from January 2019 to December 2024. Using this, we could get the quarterly and yearly new gold loan given in Tons.

| Metric | Value |

| Estimated Total Gold Held by Indian Women | 24,000 tons |

| Value of Gold Held (at current prices) | ₹ 2,20,78,800 crore |

| Total Gold Loan Outstanding (Dec 2024) | ₹1,72,581 crore |

| % of Gold Loan to Value of Gold Held | 0.80% |

Gold Loan vs Gold Ownership

3. Clarifying the 22% Rise Claim

A. The claim says gold loans by women went up by 22%, suggesting financial stress.

B. But the TransUnion CIBIL–NITI Aayog–MSC March 2025 report clearly states that the 22% figure refers to the Compound Annual Growth Rate (CAGR) in the total number of women taking any type of retail credit — including personal, business, and other loans — between 2019 and 2024.

C. This figure is not about gold loans alone, and it does not show that women are taking loans because of financial distress.

Conclusion:

The data shows that the claim made about gold loans is not accurate. It gives the wrong impression that people are taking more gold loans because they are in trouble. But in reality, the rise in gold loans is mostly due to higher gold prices and better access to credit for women.

Key Points:

- Gold loans increased mainly because the value of gold went up, not because of economic hardship.

- Only a small part (0.8%) of the gold owned by Indian women has been used for loans.

- The 22% rise mentioned in the claim refers to the overall increase in loans taken by women (all types), not gold loans alone.

The rise in gold loans is normal and expected in a time of rising gold prices and wider access to formal credit. It does not point to an economic crisis. Therefore, the claim is misleading.