To assess the potential impact, it is essential first to understand the scale and trajectory of tourism in Jammu & Kashmir leading up to 2025. In view of the recent terror attack in Pahalgam, Kashmir, we reviewed the tourism sector since the abrogation of Article 370. We analyzed the growth, revenue generation, and its contribution to Jammu and Kashmir’s Gross State Domestic Product (GSDP) from 2019 to 2025.

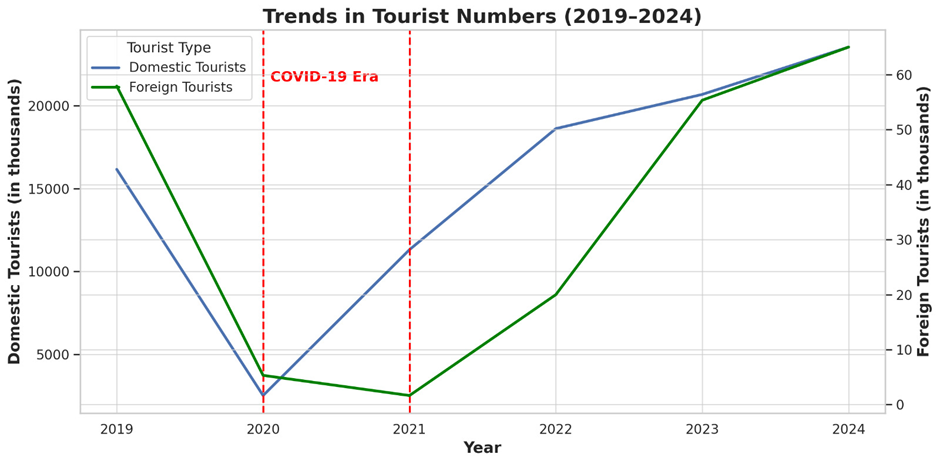

Tourist Arrivals Analysis (2019–2024):

Tourism demonstrated remarkable resilience post-pandemic, showcasing steady growth:

Tourist visits reached a record high in 2024 with approximately 23.6 million visitors, driven by improved security, infrastructure, and targeted government initiatives.

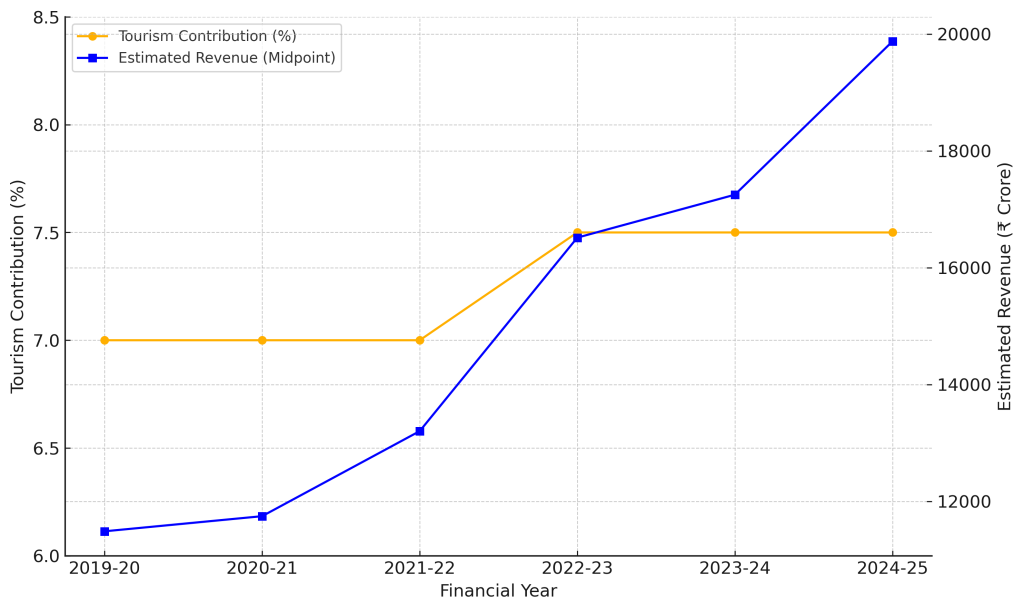

Economic Indicators and GDP Growth (2019–2025):

Jammu and Kashmir’s economy, reflected in GSDP, has steadily grown despite challenges:

| Fiscal Year | Nominal GSDP (₹ Crore) | Real Growth (%) | Per Capita Income (₹) |

| 2019-20 | 164,100 | – | – |

| 2020-21 | 167,800 | 2.26% | – |

| 2021-22 | 188,600 | 12.39% | – |

| 2022-23 | 220,200 | 16.76% | – |

| 2023-24 | 230,000 | 4.45% | 146,447 |

| 2024-25 | 265,000 | 15.22% | 154,703 |

The regional economy grew from ₹1.64 lakh crore in 2019-20 to ₹2.65 lakh crore in 2024-25. Per capita income increased significantly, reaching ₹154,703 by FY 2024-25.

Tourism’s Contribution to the Economy

Tourism contributes significantly to Jammu and Kashmir’s GDP, generally cited between 7% to 8%, aiming to reach 15% by 2030 through continued investments.

Uncertainty over future Govt initiatives:

The Jammu and Kashmir government had lined up many strategic measures to enhance tourism. These included:

- A capital budget allocation of ₹390.20 crore for tourism infrastructure (FY 2025-26).

- Development of new tourism circuits, cultural heritage sites, and adventure tourism opportunities under the SPREAD initiative.

- Promotion of homestays and sustainable tourism to diversify tourist offerings and improve local economic benefits.

These steps aimed to elevate tourism’s contribution from current levels (~7%) to approximately 15% of the GSDP in upcoming years. However, the deteriorated security situation threatens to derail these development plans and delay the anticipated trajectory of tourism-led growth.

Potential Loss Estimate

- Immediate Fallout:

- Tourist Cancellations: 90% immediate cancellations. Hotel occupancy dropped from near-full to 60–80% vacancy rates. Direct cancellations threaten peak-season revenue.

- Revenue Loss Estimates: Projected decline from 23.6 million (2024) to around 16.2 million (2019 levels), a 31% drop. Direct loss estimated at around ₹2,516 crore, assuming an average spend of ₹850/day over 4 days. Broader economic losses (including indirect and multiplier effects) are estimated conservatively at ₹7,000–₹10,000 crore.

- Employment and Local Economy:

- Significant job losses in hospitality, transportation, and informal sectors.

- Small businesses (handicrafts, vendors, houseboats) would face severe financial distress, with up to 80–90% reliance on tourism.

- Rising unemployment risks, potentially reversing recent declines (from 6.1% back towards pre-2019 levels of ~8%).

2. Medium to Long-Term Economic Risks:

- GSDP Contraction: Tourism contribution projected to fall below 5.5% of GSDP from the pre-attack level of 7–8%. Jeopardizes the long-term government goal of reaching 15% tourism share of GDP by 2030.

- Sectoral Ripple Effects: Reduced demand affects horticulture, agriculture (apples, saffron, walnuts). Increase in banking sector NPAs due to defaults by tourism-dependent businesses. Declining real estate values in tourism-dependent regions (Gulmarg, Pahalgam), affecting sectoral contributions (18.3% GSVA in 2024-25).

3. Psychological and Recovery Challenges

- Attack severely damages the “safe destination” narrative cultivated through initiatives like the 2023 G20 Tourism Summit and record Tulip Garden attendance (8.14 lakh visitors in 2025).

- Likely resumption of negative international advisories (US, UK), reducing foreign tourist inflows significantly (65,000 international arrivals in 2024).

4. Suggested Government Response: To stabilize the sector and rebuild confidence, the government could consider the following:

- Immediate relief package for affected tourism operators and small vendors.

- Deployment of a security surge in key tourist zones with visible public communication.

- Fast-tracking tourism diversification projects (eco-tourism, adventure circuits).

- Credit guarantees for hotels and houseboats facing cashflow distress.

- Strategic communication campaigns targeting domestic travelers.

Conclusion:

Tourism in Jammu and Kashmir had shown strong post-pandemic recovery, becoming a critical pillar of the region’s economy before the attack. Visitor numbers and economic contributions have steadily increased, highlighting the sector’s critical role in regional economic development.

While current estimates suggest tourism contributes approximately 7-8% annually to the GSDP, ambitious government strategies could have substantially increased this figure over the next decade. The recent Pahalgam terrorist attack, which specifically targeted tourists, has disrupted this momentum. A tourist exodus is underway, and the impact is likely to be long-term. The potential loss to Jammu and Kashmir’s economy could be more than Rs. 10,000 crores annually.

A portion of the diverted tourist flow may benefit other tourism-intensive states, creating a window for capacity expansion outside J&K. The planned investment in Jammu and Kashmir’s tourism sector may also take a hit in the future.

References:

- Ministry of Tourism, Govt. of India (2023). India Tourism Statistics 2023.

- Economic Survey of Jammu and Kashmir (2024-25). JK Planning Department.

- Greater Kashmir (2023). “Tourism generates Rs 8,000 crore annually in J&K”.

- IBEF. Jammu and Kashmir Economic Growth Report.

- The Hindu (2024). “J&K economy expected to grow at 7.06%”.

- Deccan Herald (2024). “Kashmir breaks previous tourism arrival records in 2024”.

- Business Today (2025). “Tourism revenue and projections for Jammu & Kashmir”.

- ResearchGate (2023). “Economic Impact of Tourism in Jammu and Kashmir”

Data Map:

| Aspect | Data Sources | Data Type | Years Covered |

| Tourist Numbers | Ministry of Tourism, Economic Surveys, News Reports | Domestic & International Visitors | 2019–2024 |

| Tourism Revenue | Greater Kashmir, Ministry Reports, Economic Surveys | Annual Revenue Estimates | 2022–2024 |

| GDP Data | Economic Surveys, Wikipedia, IBEF | GSDP (INR Crores) | 2019–2025 |

| GDP Contribution | Economic Surveys, ResearchGate, Greater Kashmir | Percentage Estimates | 2019–2025 |