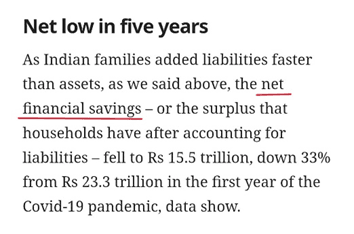

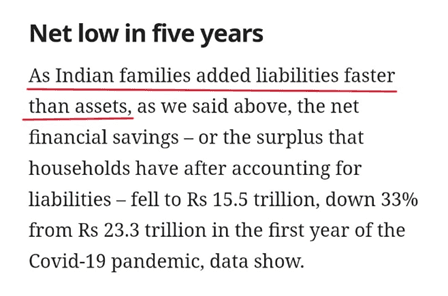

Claim: An article published by online portal Scroll claims that household savings have fallen significantly. The article also claims that Indian Households added liabilities faster than assets in 2022–23.

Our examination found the claim to be MISLEADING.

How we examined the claim:

- We checked the Net Financial Assets (NFA) definition used by RBI. NFA is defined as Cash plus Bank Deposits plus Equity Linked Investments minus all Loans and Debt taken. While Scroll article treats NFA as a measure of savings, this is a fundamental error. NFA completely ignores physical or non-financial assets like real estate, gold, and durable goods, which are among the most common outcomes of household saving. When people use their financial assets or take loans to buy such assets, their liquid financial position on paper weakens, but their actual wealth rises. NFA fails to capture this shift, making it a distorted and misleading measure of savings.

Take a simple example. A household with ₹10 lakh in financial assets and no debt has an NFA of ₹10 lakh. If it uses this ₹10 lakh as a down payment for a ₹40 lakh house and takes a ₹30 lakh loan, its financial assets drop to zero, and liabilities rise to ₹30 lakh. Its NFA becomes negative ₹30 lakh. But it now owns a house worth ₹40 lakh. The household is clearly wealthier, yet NFA suggests it is worse off.

This distortion shows why NFA is not a true reflection of savings. It captures net financial liquidity, not actual asset accumulation. It might be useful for judging short-term solvency, but it is entirely inadequate for understanding long-term saving behavior or real household wealth. Any meaningful assessment of savings must include both financial and physical assets.

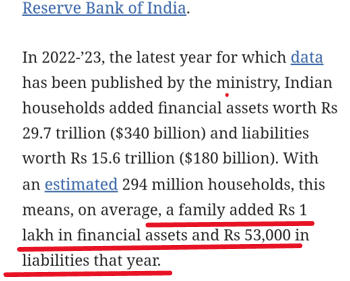

2. The Scroll article claims that Indian families added liabilities faster than assets.

However, the same article quotes data published by RBI which shows each household added Rs 1 lakh in financial assets and only Rs 53000 in financial liabilities in 2022-23. We verified this data with RBI reports.

Conclusion:

The Scroll article misrepresents NFA data to indicate household savings. This mischaracterization is categorically rejected by the definition of NFA used by RBI. The article also uses language that creates the impression that Indian households added liabilities faster than assets. Data published by the RBI clearly contradicts this claim.

Therefore, the claim is Misleading.

References:

Reserve Bank of India. (2025, June 28) Flow of Financial Assets and Liabilities of Households: Instrument-wise [Data set]. Reserve Bank of India. Retrieved from https://website.rbi.org.in/web/rbi/-/publications/flow-of-financial-assets-and-liabilities-of-households-instrument-wise

Finskeptics. (2025, June 28). Fact-check: Is India’s middle class struggling with stagnant incomes, soaring debt, and falling savings? Retrieved from https://finskeptics.com/fact-check/fact-check-is-indias-middle-class-struggling-with-stagnant-incomes-soaring-debt-and-falling-savings/