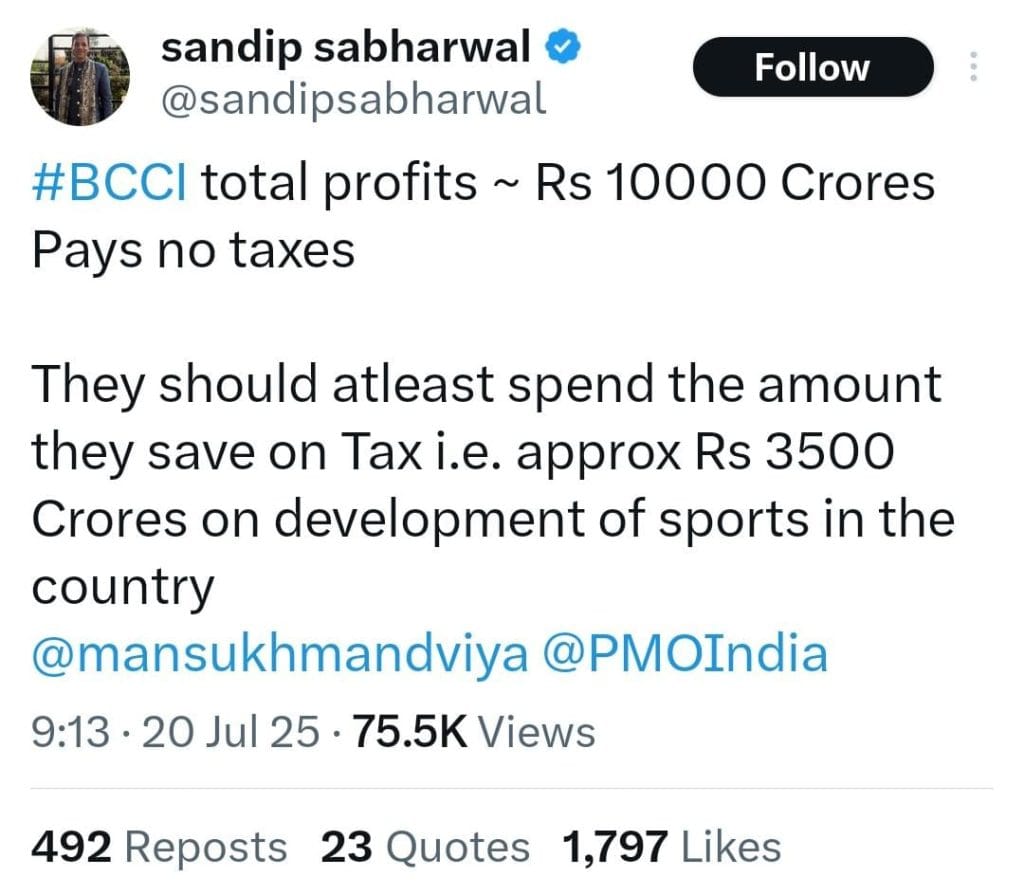

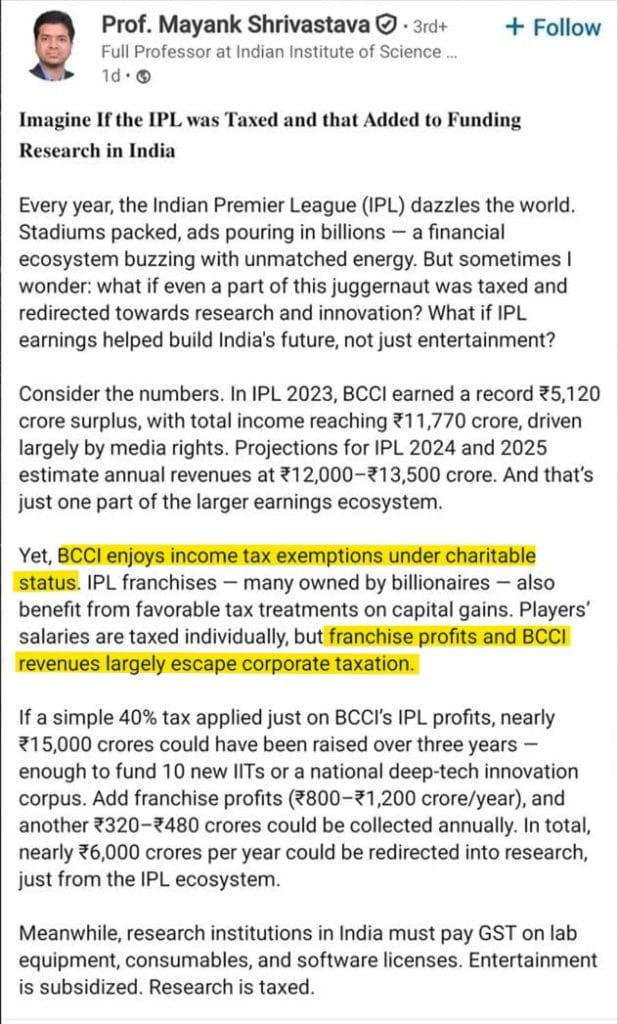

Claim: Many finfluencers, professors, journalists and other social media users have claimed that BCCI (The Board of Control for Cricket in India) pays zero income tax. Another claim states that BCCI made a profit of Rs 10,000 crores in the year 2023-24. It is also claimed that IPL franchises also avoid paying corporate tax.

Our examination found the claims to be False.

How We Examined the Claim:

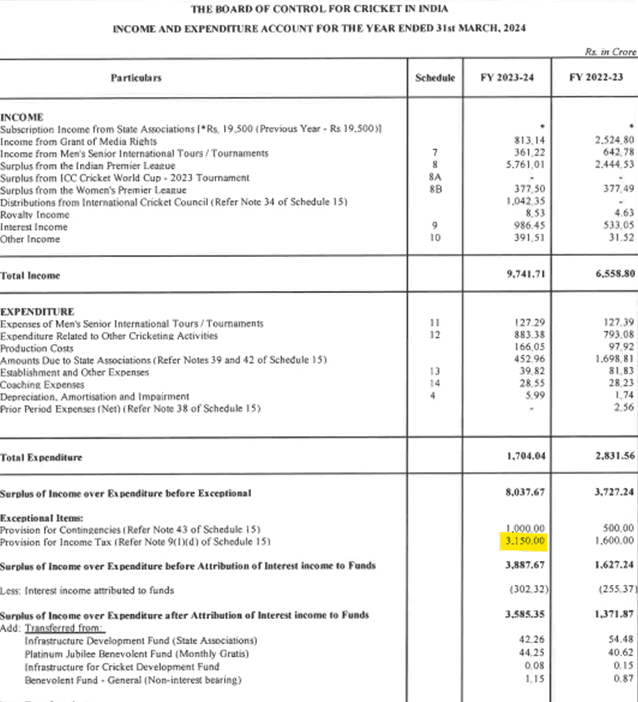

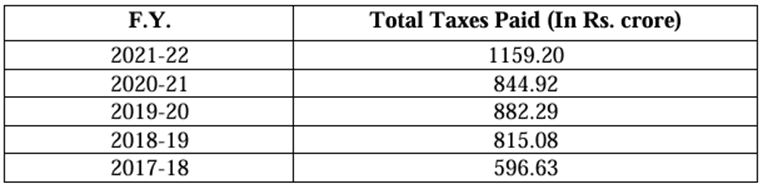

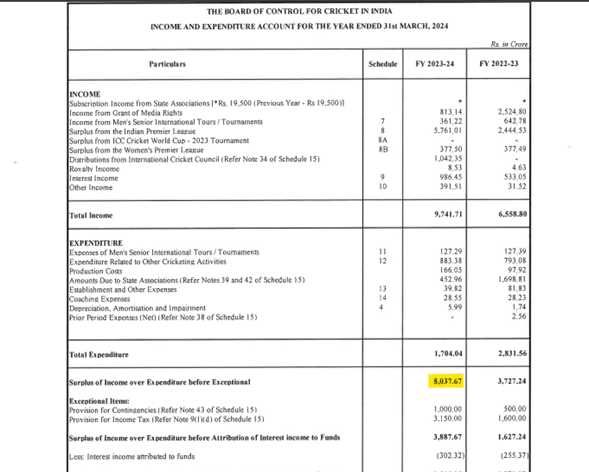

1. We examined BCCI’s audited financial statements for the year 2023-24. The income and expenditure account clearly states an income tax provision of Rs. 3,150 crores. This is consistent with the information provided in response to Rajya Sabha’s Unstarred Question No. 2154, “Tax History Payment of BCCI.” It is clear that BCCI has been paying substantial income tax to the exchequer and with rising revenue the amount has sharply gone up in recent years.

2. We examined the audited financial statements of BCCI for the year 2023-24. Income and Expenditure Account (Pg 13) shows that an amount of Rs 9,741 crores is the gross revenue of BCCI and not profit. To arrive at BCCI’s surplus for the year, expenditure of Rs 1,704 crores has been deducted, leaving a surplus of Rs 8,037 crores.

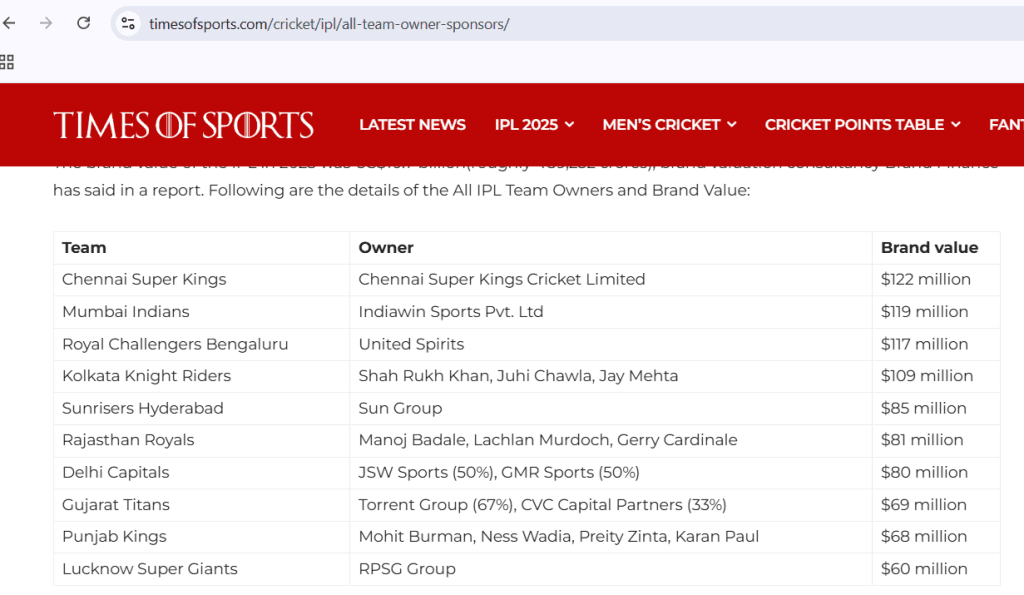

3. We examined the tax status of IPL franchises. As examples, MI (Mumbai Indians) is owned by Indiawin Sports Private Limited and RCB (Royal Challengers Bangalore) is owned by United Spirits. Some franchises are also part owned by individuals. All such companies and individuals are taxable under the Income Tax Act 1961.

Conclusion:

BCCI’s tax-free status under the Income Tax Act 1961 has been widely misinterpreted to give the impression that BCCI does not pay income tax. BCCI’s tax exemption applies in a strictly limited sense to sports promotional activities where both the income and expenses must satisfy tax exemption conditions. As a result, BCCI has paid substantial income tax on its activities with their income tax provision for the year 2023-24 reaching Rs. 3,150 crores, the highest ever in BCCI’s history.

Additionally, we can see from BCCI’s audited financial statements that revenue of Rs. 9,741 crores was the gross revenue for the year, not profit as claimed by some finfluencers.

Lastly, IPL franchises are owned by private companies and they enjoy no special tax status.

Therefore, the claims are False.