Claim: Government is about to introduce a new GST on RWA (Resident Welfare Association) maintenance charges. It will be applicable on those residents paying over 7500 INR per month or more.

Several online forums and social media accounts on X have circulated claims alleging that the government plans to introduce a new GST on RWA (Resident Welfare Association) maintenance charges.

Market Growmatics, an online platform that ‘supports both startups and non-startup ventures’, echoed this allegation, which was subsequently amplified by numerous X users.

X user Paul Koshy (@Paul_Koshy) commented on the same allegation, directly attacking the Finance Minister.

Another X user Indian Gems (@IndianGems_), also circulated the claim.

Our examination found the claim to be MISLEADING.

How we examined the claim:

We checked all Government communication handles and the Finance Ministry website. We did not find any new proposal to levy GST on RWA maintenance charges.

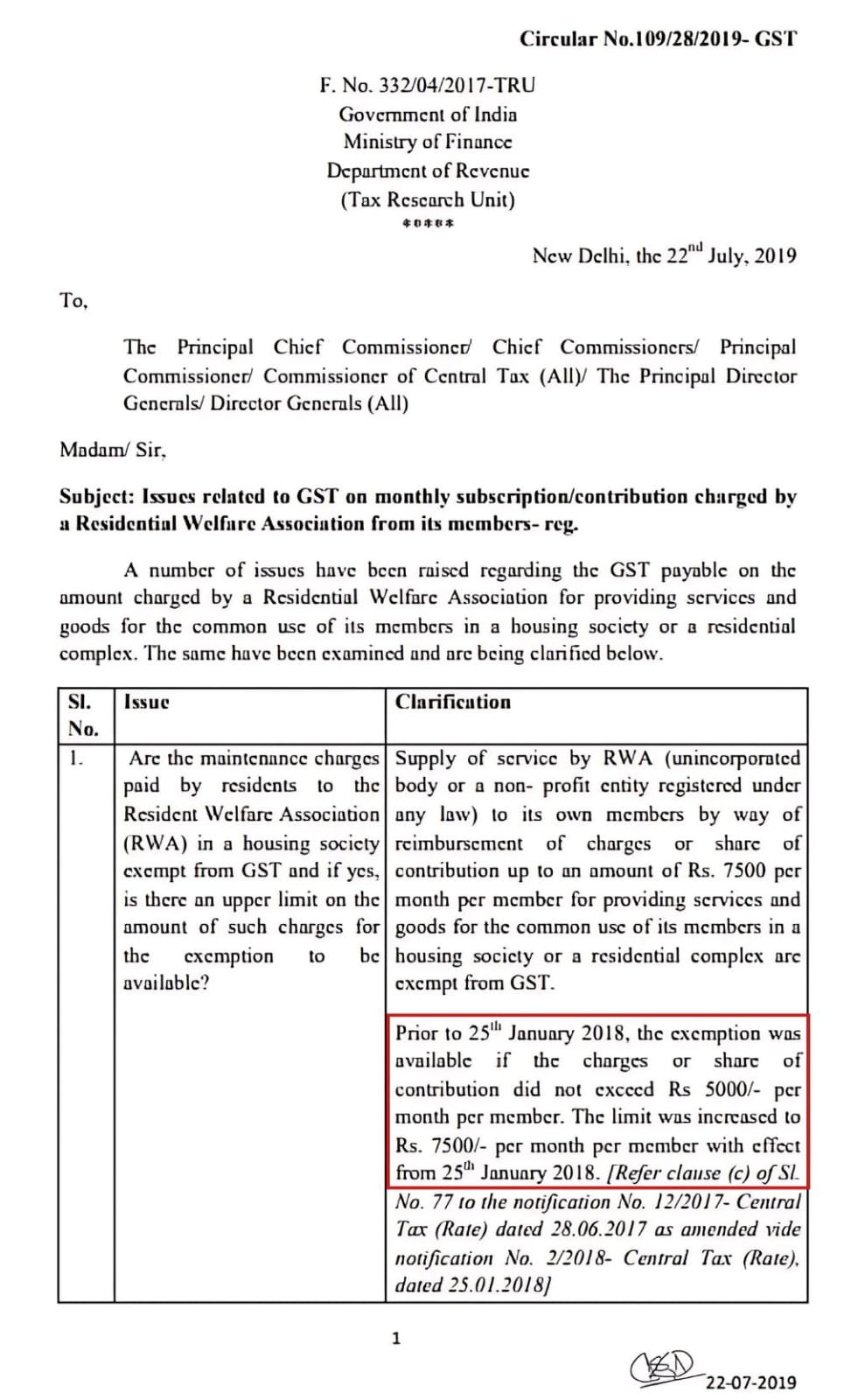

Additionally we found Circular No. 109/28/2019‑GST (Ministry of Finance, 22 July 2019) that states that maintenance contributions up to ₹7500 per member per month are exempt from GST, while any amount above ₹7500 (for RWA’s with annual turnover exceeding ₹20 lakh) is taxable at 18 % since mid‑2019.

Conclusion:

The 18 % GST on society maintenance is not a recent measure but a policy in force since July 2019. It applies exclusively to larger, premium RWAs whose dues and turnover exceed clearly defined thresholds, leaving small and mid‑range communities exempt. There is no proposal to introduce any new GST on RWA maintenance. The recent clarification by the government only reiterates the 2019 circular and is not a new measure. Therefore the claim is misleading.