Claim: India plans to levy GST on UPI transactions exceeding Rs 2000

Several social media handles on X have circulated claims suggesting that the government intends to impose GST on UPI transactions exceeding ₹2,000.

A post by user @IndiaGems_ claiming the same, was widely shared by several users on X. Another user CA Vivek Khatri (@CaVivekkhatri) circulated the same claim, garnering a good number of likes and retweets

Another X user Sumit Kapoor @moneygurusumit shared the ET Now report and added that “The change will drastically impact daily spending, especially for small businesses, freelancers, and middle-class families.”

Several X handles including UmdarTamker (@UmdarTamker) shared memes on the same.

Our examination found the claim to be FALSE.

How we examined the claim:

We checked all Government communication handles and Finance Ministry website. We did not find any proposal to levy GST on UPI transactions. The alleged claim also goes against the basic nature of GST which is a value added tax on Goods and Services. On the other hand UPI transactions are electronic financial transactions.

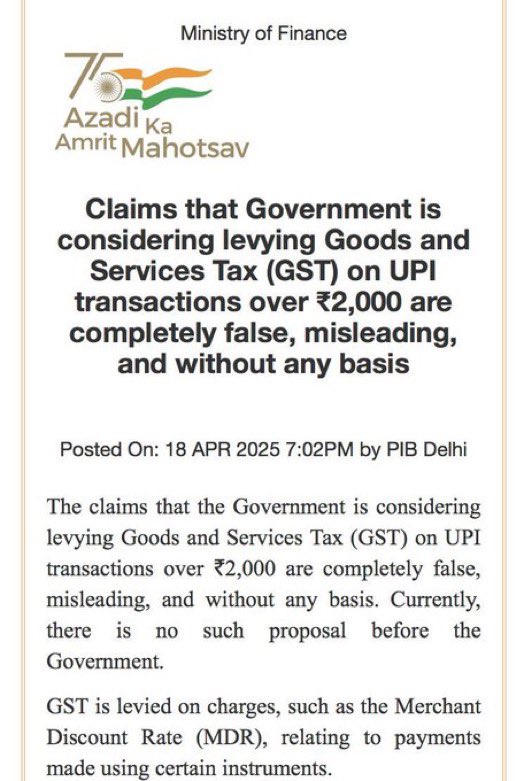

Additionally we found the following Press Release from the Ministry of Finance that categorically says, that no proposal to levy GST on UPI transactions exists.

Press Release issued by the Ministry of Finance on 18th April 2025

Conclusion:

There is no valid information available that supports the claim that Govt of India plans to levy GST on UPI transactions. Ministry of Finance has also categorically refuted the claim.

Therefore, the claim is False.