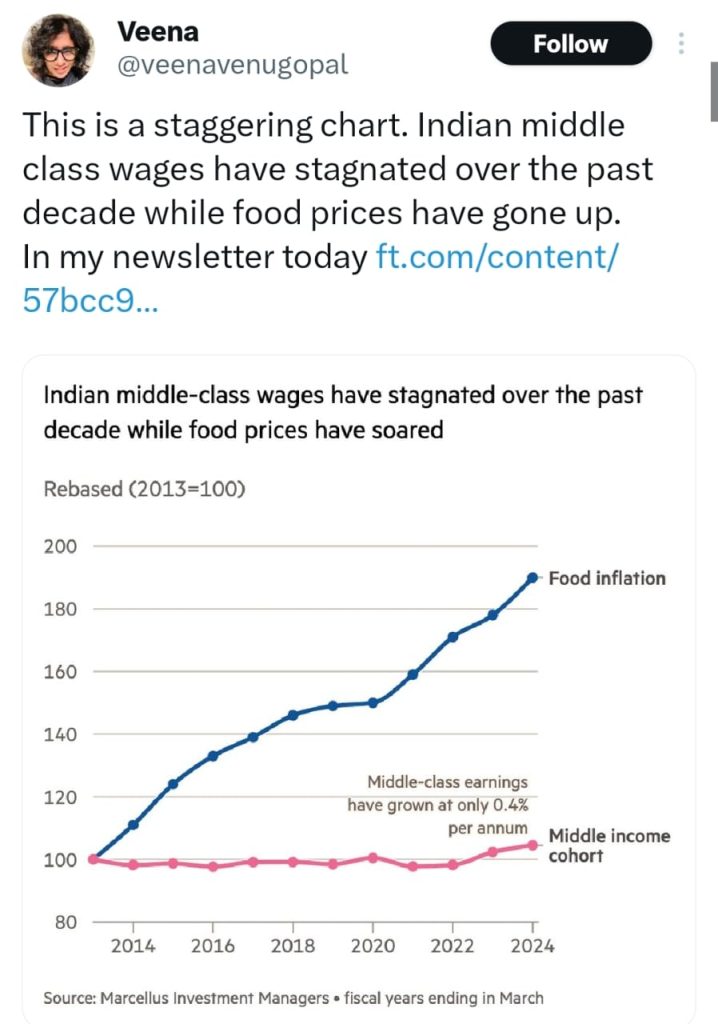

Claim: A viral tweet by Financial Times reporter Veena Venugopal claims that Indian middle-class incomes have grown at only 0.4% per annum between 2013 and 2024, while food prices have surged significantly. The implication is that the middle class is facing income stagnation and consumption stress, leading to an unsustainable reliance on credit. The Financial Times report relies on a research paper by MArcellus Investment Managers.

Our examination found the claim to be MISLEADING.

How we examined the claim:

- We checked if the 0.4 percent income growth figure for middle-class is valid.

We found the comparison methodology statistically invalid and not supported by sources.

The data source for the income figure is not cited. If it is derived from income tax return filings, this exact approach has been proven invalid in prior analysis.

The number of ITR filers nearly doubled between 2013–14 and 2022–23 from 3.6 crore to 7.2 crore. Many new filers were lower-income individuals, pulling down the average.

Therefore, the average income is diluted, and doesn’t reflect stagnation of individual incomes. This is a case of changing population base not actual wage stagnation.

2. We examined if it is meaningful to calculate a compound annual growth rate in this case.

CAGR (Compound Annual Growth Rate) assumes you are tracking the same group of people over time. When the composition of the dataset changes drastically, the trend becomes unreliable. Using CAGR to measure income growth is only valid if you are tracking the same group over time. However, if the population has changed significantly, the CAGR is analytically meaningless.

3. We examined the comparison between income growth and food inflation for statistical validity.

- Food inflation represents just a subset of the overall cost of living (CPI).

- The middle class consumes a broad basket of goods and services like housing, transport, education, health not just food.

- A legitimate comparison should be real income growth adjusted for general CPI, not just food prices.

Therefore, this comparison is statistically invalid.

4. We checked if the narrative of middle-class debt and suppressed consumption valid?

The Perfios-PwC report (Feb 2025) shows that for tech-savvy salaried individuals, 1/3rd of income is going to loan repayments.

This indicates debt stress in urban metros, but cannot be generalized to the entire middle class.

The analysis also ignores income mobility, credit cycles, and asset accumulation (e.g. home ownership, investment).

While some urban middle class maybe facing credit stress, there is no conclusive proof of this being true for all Indian middle class.

Conclusion:

The claim that middle-class income has grown at only 0.4% while food prices have surged is statistically flawed and misleading. It is based on inconsistent data samples, selective inflation comparisons, and invalid use of growth metrics like CAGR across a changing population.

There is no credible evidence to support the claim of decade-long income stagnation for the Indian middle class. What the data actually shows is a trend of increased formalization, broader tax compliance, and diversifying income profiles.

While some segments of urban salaried individuals may be under debt-related stress, this cannot be generalized to represent the entire middle class. The broader picture is of economic transition, not income collapse.

The real story is one of formalization and economic transition not wage collapse. More people are entering the formal tax system, and while short-term credit stress exists, it does not support the sweeping claim of decade-long income stagnation.

Therefore, the claim is misleading.