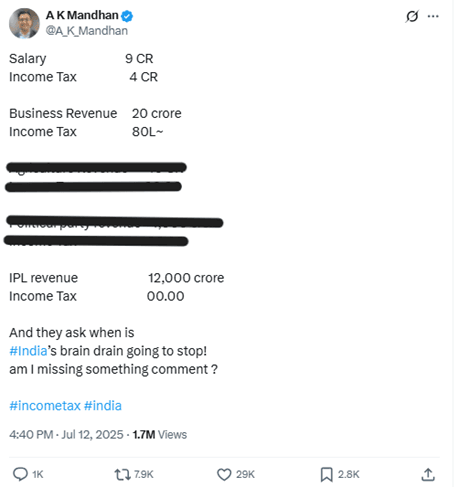

Claim: A Social Media influencer has claimed in a viral tweet that IPL (Indian Premier League) pays zero tax on Rs 12,000 crores revenue, income tax on Rs 20 crores business revenue is only Rs 80 lakhs and on salary income of Rs 9 crores, income tax payable is Rs 4 crores.

Our examination found the claims to be MISLEADING.

How We Examined the Claim:

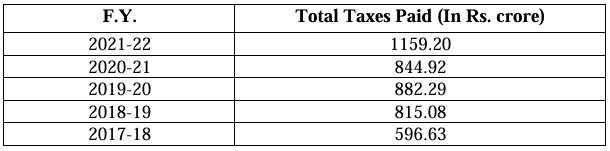

1. We examined how IPL revenue is utilized. About 50% of IPL revenue from Central contracts is distributed to various franchises where it is liable to income tax as these franchises are for-profit (Ref 1). BCCI (Board of Control for Cricket in India), as the organizer of IPL may generate a surplus after deducting expenses. BCCI is a charitable body that does not generate or distribute any profit to any individual. As a tax-exempt charitable body, it is required to invest any surplus they may generate in the promotion of cricket for the benefit of people. Wherever any income or expense fails to meet this requirement, BCCI also pays income tax as seen in the table below.

Income Tax paid by BCCI (latest available data):

2. We examined how the Income Tax Act of 1961 taxes business income (Ref 2). Income tax is calculated on profit generated by the business after deducting allowable expenses from revenue.

Income tax is not calculated on gross revenue. It would not be possible to calculate income tax payable based only on revenue. We found that in the attached tweet, only revenue figure is provided.

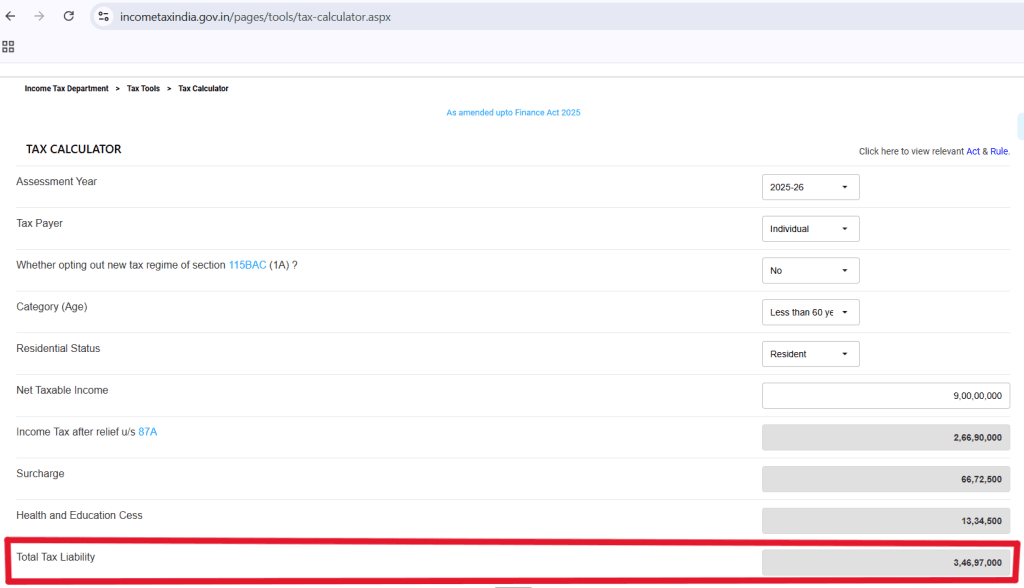

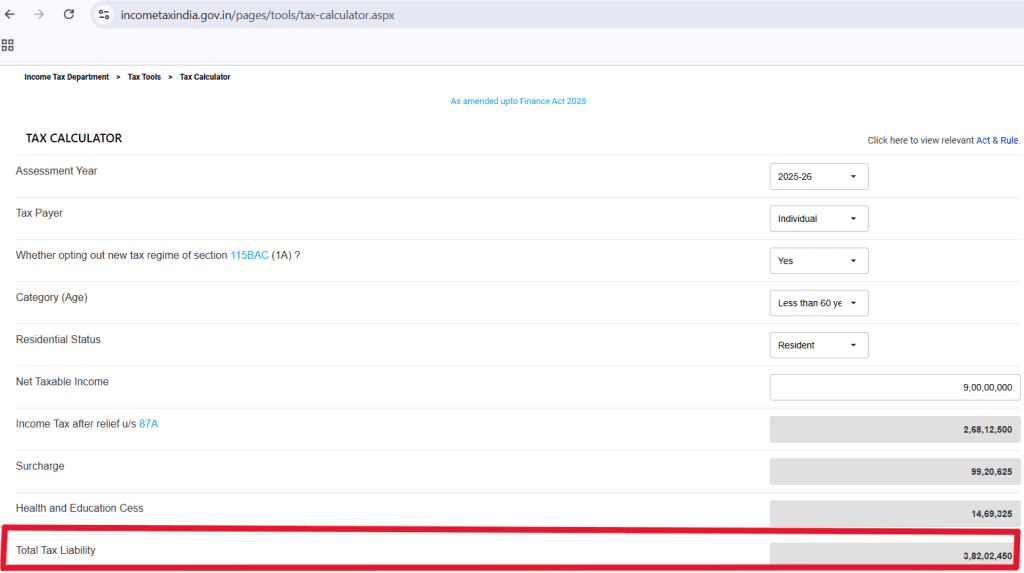

3. We examined how the Income Tax Act of 1961 taxes salary income (Ref 2). Due to lack of information about deductions etc. we can approximate the income tax due for the example cited. As seen from the income tax calculator from CBDT (Central Board of Direct Taxes), the income tax payable on Rs 9 crores income would be approximately Rs 3.46 crores under the new tax regime (Picture 1). The tax payable would be approximately 3.82 crores under the old tax regime (Picture 2).

Conclusion:

The Finance influencer’s claim that zero income tax is paid on Rs 12,000 crores IPL revenue lacks context. While BCCI is partly tax-exempt, the entire revenue does not belong to BCCI. It is also clear that BCCI does pay income tax as all its income may not be tax exempt. The claim about Rs 80 lakh income tax payable on Rs 20 crores business revenue is also baseless. Income tax is calculated on profits. Providing revenue figure of 20 crores and linking it with an imaginary 80 lakh tax figure is highly misleading. A business may earn a high revenue yet still make losses. Similarly, the claim about Rs 4 crores income tax on Rs 9 crores salary is not accurate. Depending on which tax regime (old or new) the individual has opted for, the income tax due would be less than Rs 4 crores.

Therefore, the claims are Misleading.

References: