India-China GDP Debate: Finfluencer Akshat Shrivastava asserts that “China’s net exports are nearly 26% of India’s GDP.” A detailed analysis explores insights from leading economists on the matter.

Recently, the social media saw significant furore when Akshat Shrivastava, a finfluencer, claimed that “China’s net exports is almost 26% of India’s GDP.”

The immediate question that arises is, “Is that really true?” This highlights the need for a thorough analysis of the metrics used to compare the GDP growth of these two nations, which operate under vastly different dynamics.

India vs. China: Are the Two Economies on Equal Footing?

Some of the leading economists and experts on the country’s economic growth highlighted the glaring anomaly in the comparison –

Nilesh Shah, MD of Kotak Mahindra AMC, emphasized that “India and China were of similar economic size in the 1980s, but today, China’s economy is five times larger. Over the past four decades, China has undeniably outpaced every other economy, including India. Their execution capabilities are unparalleled, partly due to the absence of dissent in their system. For example, compare the construction of the Mumbai Sea Link with the China-Hong Kong Sea Bridge. China not only built a hospital in Wuhan within seven days but also managed to shift the narrative from ‘Wuhan virus’ to ‘COVID-19.’ Furthermore, China has been able to recruit thousands of scientists and engineers from the Western world, offering competitive pay packages without concerns about quotas or pay commission regulations, to address challenges like U.S. chip sanctions.”

The post on X mentions, “China is building next gen exports in robotics, semiconductor, AI etc. India: ? (not sure what exactly are we doing) Our biggest hope seems to be: export smart people to other countries. And, they send money back in the form of remittances.”

India Vs China: What’s the export picture like?

Commerce and Industry Minister Piyush Goyal recently projected that India’s exports of goods and services could surpass $800 billion in FY25, setting a new record despite global economic uncertainties. For context, exports in the previous fiscal year (FY24) were $778 billion, according to data from the Ministry of Commerce and Industry.

Additionally, the Commerce Ministry’s data shows that India’s total exports, including merchandise and services, increased by 4.86% year-on-year, reaching $393.22 billion during the first half of FY25 (April to September).

According to Chinese government data, exports in 2024 grew by 7.1% year-on-year to 25.45 trillion yuan (approximately $3.66 trillion), while imports rose by 2.3% year-on-year to 18.39 trillion yuan (around $2.65 trillion). Speaking at a press conference in Beijing on January 13, Wang Lingjun, Deputy Head of the General Administration of Customs (GAC), noted that China’s foreign trade growth in 2024 was notably strong. In December 2024, imports and exports reached record monthly highs, surpassing 4 trillion yuan (about $576.20 billion), reflecting a 6.8% year-on-year increase. Additionally, foreign trade for the fourth quarter of 2024 totaled 11.51 trillion yuan (approximately $1.65 trillion), with the quarterly growth rate accelerating by 0.4 percentage points compared to the third quarter of the same year.

India Vs China: Trade Deficit or Trade Surplus

China reported a trade surplus of nearly $1 trillion in 2024. In contrast, India’s trade deficit for December showed a significant month-on-month narrowing. However, for the financial year to date, the trade deficit widened to $210.8 billion in FY25 (April-December), compared to $189.7 billion during the same period in FY24. This increase is largely attributed to higher crude oil imports.

Crude oil imports from Russia accounted for 39% of India’s total imports in FYTD25 (in volume terms), consistent with the previous year. The data indicates that the rise in trade deficit was driven by increased import volumes and reduced discounts on crude oil purchases from Russia.

Gaura Sen Gupta of IDFC First Bank highlighted that India’s growth model has predominantly been driven by domestic demand, with limited participation in global trade. India’s merchandise exports currently account for 1.8% of global trade, a figure that has remained stagnant in recent years. However, notable progress has been achieved in the services sector, where India’s share in global exports has increased to 4.3%, up from 3.4% five years ago.

She emphasized that leveraging India’s favorable demographics, which are expected to remain advantageous for over 25 years, makes focusing on domestic demand a more sustainable strategy. On the export front, she suggested prioritizing a move up the value chain, especially as domestic labor costs continue to rise.

India to remain fastest growing Economy

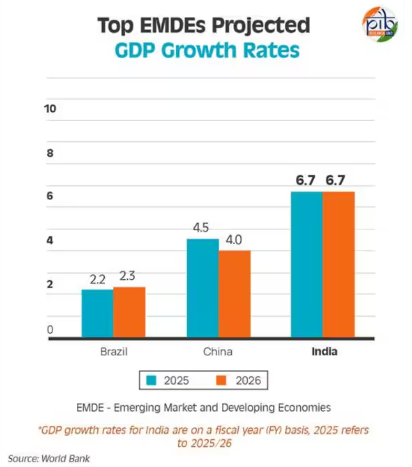

India is poised to maintain its position as the fastest-growing major economy over the next two fiscal years, according to the January 2025 edition of the World Bank’s Global Economic Prospects (GEP) report. The report forecasts steady economic growth of 6.7% for India in both FY26 and FY27, far surpassing the projected global growth rate of 2.7% for 2025-26 and outpacing its regional and global peers.

during FY26 and FY27 as per World Bank projections. (Image Courtesy: PIB)

Supporting the World Bank’s findings, the latest update from the International Monetary Fund’s (IMF) World Economic Outlook (WEO) also highlights India’s strong economic momentum. The IMF projects India’s growth to remain steady at 6.5% for both 2025 and 2026, consistent with its earlier forecasts from October.

Concerns have been raised regarding the slowdown in India’s growth rate from the previously projected 7% or higher figures. Dipti Deshpande, Principal Economist at Crisil, explained that India’s GDP growth decelerated to 6.4% in fiscal 2024, driven by reduced fiscal stimulus, higher interest rates, and stricter lending norms that impacted urban demand. Despite this, the Indian economy maintains its position as the fastest-growing major economy. Private consumption, which had lagged in the previous fiscal, has seen a recovery this year, buoyed by stronger rural demand. Meanwhile, consumer price inflation is gradually moving closer to the central bank’s target. However, elevated food inflation remains a significant challenge, hindering the possibility of policy rate cuts.

She added that “even as geopolitical uncertainty remains elevated, India’s growth remains domestically driven. Its external sector too displays resilience supported by a low current account deficit, adequate foreign exchange reserves, and a comfortable external debt situation.”

What can we conclude?

Discussions with experts and analysis of multiple reports suggest that while Akshat Shrivastava’s claims may hold some merit in numerical terms, they may not entirely align with the current context. Nilesh Shah, Managing Director of Kotak Mahindra AMC, highlighted that India and China’s economic models are not directly comparable due to their distinct political structures. He explained, “The economic model of autocratic China differs significantly from the rest of the world. It is challenging for any democracy, including India, to adopt a similar approach. India must grow in alignment with its cultural values, which is achievable by granting greater freedom to entrepreneurs. While India has made progress in improving the ease of doing business, a quantum leap is necessary to compete with China.”